Salary advance loans are temporary solutions for salaried individuals seeking out credits for the short term due to immediate financial need. But the interest rates for this particular loan type is usually high and is calculated either on a monthly or daily basis, depending on the lenders. You have to be careful which lender you choose to avoid exorbitant interest rates that can get out of control fast.

GET US AND CANADA LOANS APPROVED FAST HERE

People with even average credit scores can also apply for the same. However, because of their high-risk nature and fast processing time, these loans have high APR, and the repayment terms are also in favor of the lenders.

Top Applications For Salary Advance Loans

Many applications or companies are providing Salary Advance Loans.

● Early Salary

● Loan Tap

● Quick Credit

● Cash Kumar

● Credit Bazaar

● Flex Salary

● Payme India

All of these applications provide different interest rates for loans on salaries.

A Salary Advance Loan Calculator is also used to calculate the estimated interest amount based on loan tenure and loan amount. Borrowers also can use the calculator to calculate their personal, house and other loans.

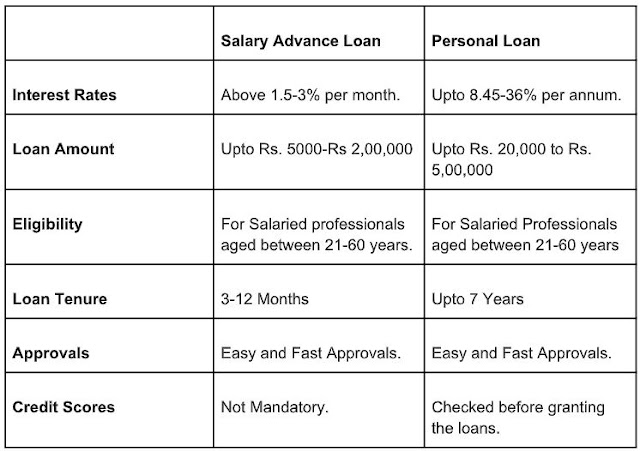

Differences Between Salary Advance Loans And Personal Loans

Salary is remuneration provided to employees every month for performing their roles in the company. When employees apply for a loan against a salary account, they literally promise the lender to pay off their debt on the next credit of their salary. Advance payment of salary is when the company obligates their employees by crediting the salary in advance so that the borrower can meet the current contingencies. Personal loan is again the loan provided to salaried people, against a mortgage other than salary account.

Eligibility For Availability Of Advance Salary Loans

Lenders do not go into the details for past credit histories while providing Advance Salary Loans. But the borrower needs to meet some conditions to be eligible for the loan type.

● · Borrower’s Age must be or above 21 years.

● · The net salary or profits from the business must at least draw:

- Rs.40,000 for Mumbai, Hyderabad, Chennai, Thane or Delhi residents.

- Rs.35,000 for Pune, Kolkata and Ahmedabad residents.

- Rs.30,000 for any other city resident.

● · The borrower must have an active and operating Savings Bank Account.

● · They need to be residents of India.

● · They need to have all the documents in hand.

Documents Required For Salary Loans And Advances

● Photogenic Identity Proof: Driver’s license, voter ID, Passport or Pan Card.

● Address Proof: Internet or Telephone Bill, Driver’s License, Certified Employer Letter, Ration Card, House Deed, Passport.

● Signature Proof: Bank Verification Letter, Pan Card, along with some signatures.

● Age Proof: PAN Card, Driver’s License, Birth Certificate, Passport.

● Passport Sized Photograph: Keep Around 4-5 in hand with you while applying.

● Current and Previous Employment: Confirmations, Transfer or Appointment Letters.

● Financial Statement: Pay Slips. ITS Report or audited financial reports for salaried person

● Employment Proof: Business Visiting Card or Employee ID.

● Bank Statements: Salary Credited Bank Statement for last three months.

How To Get An Advance Salary Loan Approved

The borrower needs to follow some simple steps to apply for advance salary loans. These steps include:

· Filling out the application form. The form needs to be filled out with some required personal information and income details.

· Wait for the approvals after filling out and submitting the forms.

· Collect the essentials and required documents for the KYC process.

· After the verification of documents, the amount is credited to the borrower’s account.

Benefits And Features Of Salary Advance Loans

● Zero Or Minimal Closure Charges: Borrowers have an open option to close their loans by paying the amount earlier. This will not levy any penalties or additional charges on them.

● Part Prepayment facilities: Borrower can pay out their loan amount either in EMI’s or full amount at once, depending on the lender.

● Online Account Access: Lenders offer the facility to keep a real-time check on the finances they owe and the total amount they need to pay in total at the end.

● Financial Emergencies: You can sort out the financial emergency issues with advance salary loan options, as they have a flexible time repayment period.

● Insurance Cover: Some lenders will also provide credit shield facilities and personal accident cover additionally with the loans.

Tips For When To Borrow Money On A Salary Advance Loan

Salary Advance Loans have comparatively higher interest rates. These are thus ideal only for wants or some financial emergencies. Going for the loan type to cover leisure expenses is strictly not advised.

There are certain financial crunches where employees can apply for the same. These include:

● Unexpected Financial Setback

● Bereavement Costs

● Family Emergencies

● Health Emergency

● Payment of bills not covered under insurance

These are typically not an ideal option for daily or regular payments. Making this a habit will put the borrower in more debt, as he might be ending up paying triple the amount he has borrowed every time.

Frequently Asked Questions (FAQs) About Advanced Salary Loans

● Is an advance loan on salary taxable or not?

The amount received under the advance salary loan is taxed in the yearly receipts of the employees.

● What is the advance salary loan interest rate?

The interest rate for this particular loan type varies between 1.5% to 3%.

● Is an advance salary loan accepted without a credit report?

Credit Scores and reports are not mandatory while applying for salary advance loans.

● Can I use an application to deposit a cheque against an advance salary loan?

The borrower is provided with flexible repayment options. They can pay back the amount with applications or websites also.

Keep these tips in mind if you are seeking a salary advance loan approval fast!